- Inflection Point

- Posts

- Does Threads finally give Meta a viable path to winning with teens (and their advertisers)?

Does Threads finally give Meta a viable path to winning with teens (and their advertisers)?

Threads represents Meta's greatest opportunity to connect with teens and monetize their usage in years

Did someone forward you this email? Click below to subscribe and join 1000+ MBA and executive readers

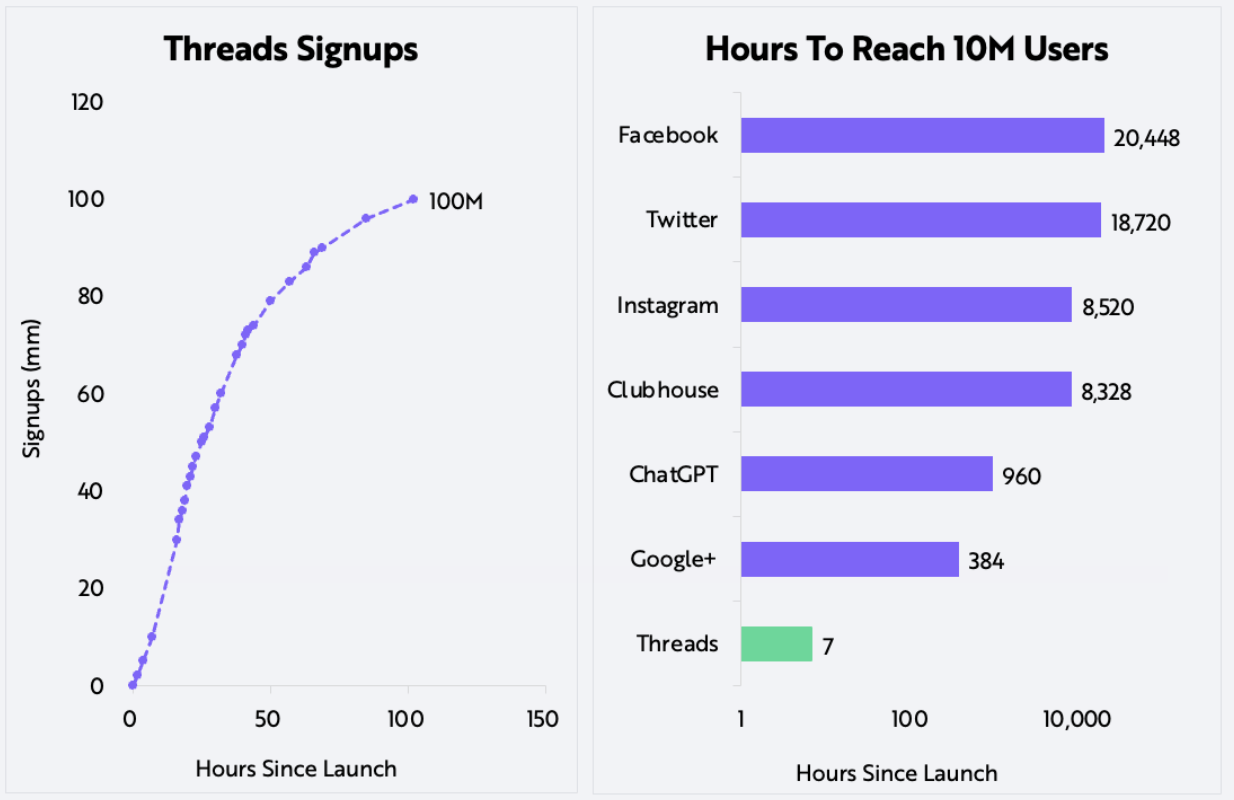

When Mark Zuckerberg and Adam Mosseri decided to unleash Threads to the masses, they may not have known with certainty how big of a hit they would have on their hands. Immediately after launch, Threads became the fastest growing social app in history, gaining 10M users within 7 hours and 100M users in less than 5 days. To put some context around this achievement we can compare it to another one of this year’s most successful launches, ChatGPT. The chat interface launched by OpenAI took nearly 140x longer to reach the same 10M user milestone:

Source: Ark Investment Management

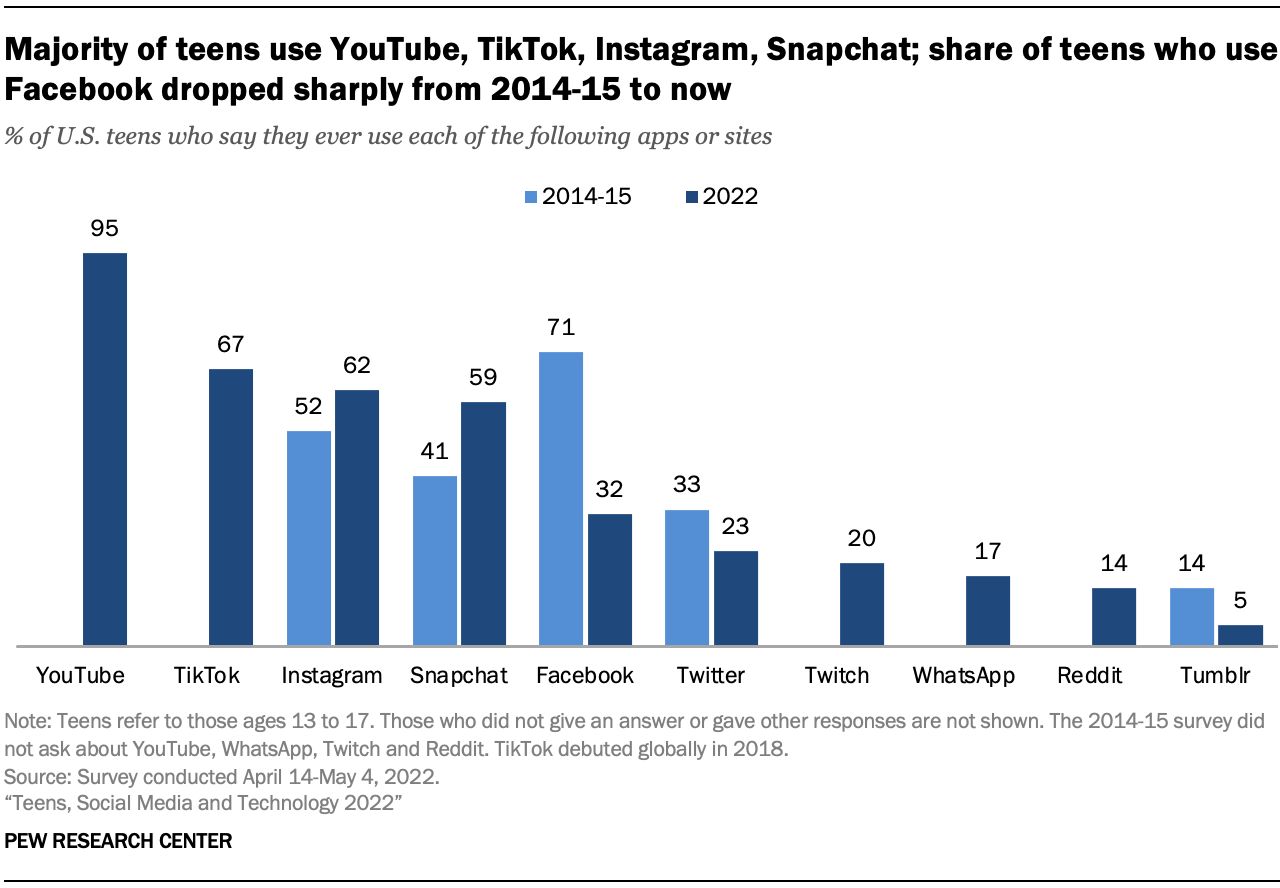

While the total number new users on Threads is massively impressive, the most meaningful data point to Meta is one we haven’t seen yet: usage among teens. For years Meta has struggled to build a winning app or use case to compete for teen’s attention and engagement. In recent years, that job has been accomplished most successfully by the triumvirate of YouTube, TikTok, and increasingly Discord. Even as IG released its short-form video competitor Reels and invested in building a TikTok-like interest graph, teens have been spending their time on apps outside of Zuck’s sphere of influence:

Source: Pew Research Center

Threads gives Meta its most recent and viable chance to shake up this leaderboard, and there is significant financial incentive to make sure that happens.

Why Threads is a critical monetization surface for Meta

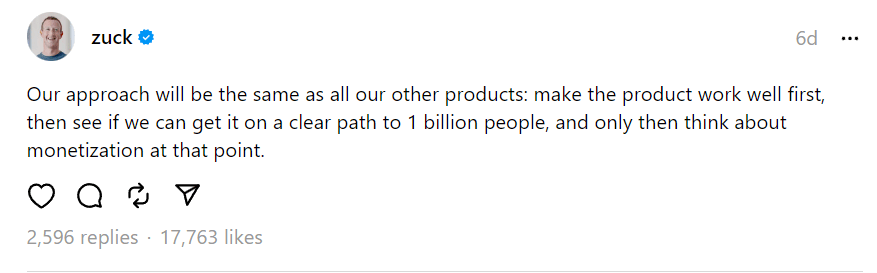

Meta’s ability to effectively monetize its apps features and surfaces is what separates the company from its peers. Critics can hem and haw all they like about Zuck’s “reputation” for copying features, but the fact is when it comes to monetizing those features, Zuck stands alone. Zuck has already stated the company won’t start monetizing Threads right away, deferring instead to massive user growth over monetization.

It’s a personal decision to decide whether or not to believe that statement, but a strong case can be made for Meta to prioritize building and refining the product to lock-in users before monetizing in the short term.

Critical among those reasons is its enormous revenue potential of text-based, vertical scrolling surface. Social media companies that generate most of their revenue from ads often measure a surface’s effectiveness with a metric called Monetization Efficiency (“ME”), often calculated as revenue earned per hour of usage. Different surfaces (e.g., IG’s Home tab, Stories, and Reels Tab) will naturally have different ME. Increasing a surface’s ME can happen in a few ways, including introducing new ad formats, expanding to new placements within the surface, or simply increasing the number of ads shown to a user. There are always teams internally whose remit is to increase the ME of their surfaces or optimize the mix of time spent on the app from low ME surfaces to ones with a higher ME

When TikTok burst on the scene with short form video (“SFV”) in 2020, it hurt Meta significantly in two ways. First was the obvious competition for engagement and usage – as users were spending more of their phone time on TikTok that meant less time was being spent on Meta’s apps. Second, Meta had to concede that SFV was a necessary content format and was forced to build out Reels to compete with TikTok for users’ time and attention. But competing with head-to-head with TikTok in SFV meant driving users to a lower ME surface than their legacy surfaces. Here is Zuck discussing that dilemma during Meta’s Q3 2022 earnings call:

“Moving to monetization, I've discussed in the past how the growth of short-form video creates near term challenges since Reels doesn't monetize at the rate of feed or stories yet. That means as Reels grows, we're displacing revenue from higher-monetizing surfaces. I think this is clearly the right thing to do so that Reels can grow with the demand we're seeing, but closing this gap is also a high priority. Even with the progress we've made, we're still choosing to take a more than $500 million quarterly revenue headwind with this shift.”

SFV is a notoriously poor surface for monetization and it’s a problem that’s not exclusive to Meta. TikTok may have a diverse portfolio of ad products and formats, but TikTok is only able to sell that ad inventory for pennies on the dollar compared to their other social rivals. The same is directionally true for ads on YouTube Shorts compared to its traditional long form video surface (you can back into CPM estimates for Shorts based on creator earnings on Shorts, but that’s a breakdown for another day).

There are several reasons SFV ads monetize poorly compared to other surfaces, but one of the most important is the scroll speed of user consuming SFV content relative to Stories or Feed content. Because it takes longer for users to consume both organic and ad content on Reels, that reduces the amount of ad content apps can show users for a given amount of usage.

The Threads format, primarily text and photo, is a familiar one for Meta and should result in an ad product and ME more similar to their other high ME surfaces like Feed and Stories. If Meta is able to successfully trade users’ time from a low ME surface like Reels to a high ME surface like Feed, all while gaining a few new users along the way, that’s a big win for Meta. Not only will they be able to deploy a proven and successful monetization playbook, it also buys the company additional time to experiment with and improve ads on Reels to close the monetization gap of that surface.

Can Threads capture Teens’ attention?

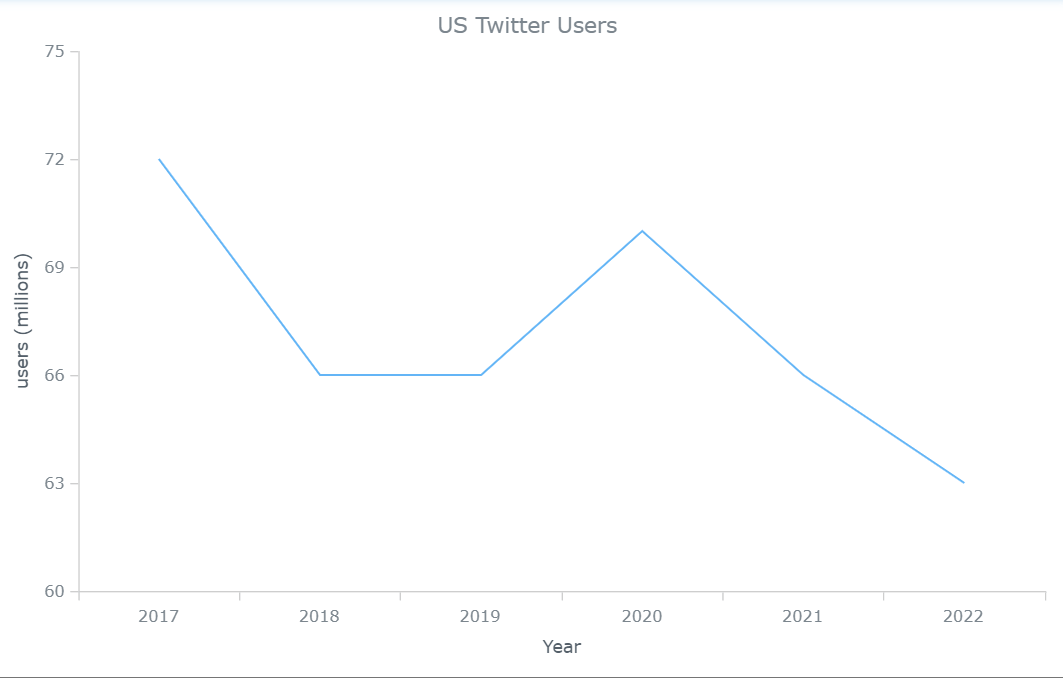

This is the biggest question facing the Threads team and it’s a big unknown. It’s worth making note that Twitter never successfully drove much teen usage. In the Pew study cited above, only 23% of teens said they ever used Twitter, a figure almost ⅓ lower than FB’s usage. I think the fact that teens never used Twitter in the first place is a positive sign for Threads. Twitter’s users in the US peaked in 2017, when the respondents to the Pew survey would’ve been 8-12 years old, and has been in a near straight decline since then. For the respondents in the Pew study (and extrapolating to teens broadly) there was little reason to create an account on a dying platform, especially as the alternatives (e.g., Snap, YouTube, TikTok) had so much to offer.

Source: Business of Apps, Twitter Statistics

We don’t know yet if teens will embrace a text-based social platform for public conversations. Twitter’s failure to capture teen interest doesn’t provide us a strong enough signal because it’s unclear if this failure was a Twitter-specific problem or rooted in teen’s aversion to the medium itself. The teams working on Meta will certainly be trying their best to answer that question. If I were on those teams, here’s what I would be testing to win with teens on Threads.

1/ Get DMs on the app immediately – Mosseri mentioned via his own Threads account that they’re considering this feature but aren’t making it a “priority”. I’ll guess that this becomes a priority sooner rather than later given 1/ how teens are embracing messaging features on Snap and Discord 2/ how private sharing has become a big driver of Reels usage.

2/ Explore a teen-specific content strategy – Maybe not rocket science here, but if you want to get teens on the platform you have to have content that interests them. Two of the most popular use cases on Twitter (FinTwit and SportsTwit) are topics that teens are less interested in. It won’t be enough to simply port over the biggest Twitter creators on Threads; the Threads team will need to identify and invest in homegrown Threads talent, specifically for teen content.

Threads lends refreshingly new life into a medium that was once dominated and championed by Twitter, but never succeeded in growing its user base to a critical mass as Twitter’s ability to innovate floundered. Though early, Threads is on pace to achieve a level of widespread adoption that Twitter failed to achieve over the last 10 years and Meta will be hopeful that their newest app can appeal to an audience that has mostly ignored its other apps over that same time period.