- Inflection Point

- Posts

- Overstock.com, Reviving Bed Bath & Beyond, and the Promise of LK99

Overstock.com, Reviving Bed Bath & Beyond, and the Promise of LK99

Plus how Amazon intends to win the grocery market

Hi everyone — today we take a close look at Overstock.com’s acquistion of the Bed Bath & Beyond brand, one of the more confusing rebranding attempts I can remember, and think critically about why it does or doesn’t make for a reasonable strategy.

Prepare for your future in business. Subscribe to build your knowledge with exclusive business analysis and career advice

📰 Need to Know News

🛒Amazon’s Grocery Gambit: Amazon is refreshing their physical and online grocery offerings as they continue to pursue their ambitious for mass market grocery appeal.

🚚Yellow goes Dark: Yellow Corp, formerly one of the largest “less than load” trucking companies is shutting down after prolonged labor negotiations led to a customer exodus that the company never recovered from.

⚡The Promise of LK99: After Korean researchers published a paper claiming to have created a “room-temperature” superconductor, the global scientific community is racing to attempt to replicate or validate their findings.

🧠 Strategy Spotlight: Investigating Overstock.com’s Dubious Rebrand

Earlier this week, the online retailer Overstock.com began redirecting visitors of their website to BedBathandBeyond.com. This came after Overstock acquired the brand rights for Bed Bath & Beyond (“BBBY”) earlier this year. From the WSJ:

Overstock, known for selling furniture, is rebranding in the U.S. as Bed Bath & Beyond to signal its investment in bedding, towels, dishware and other home goods. Overstock’s website now redirects to Bed Bath & Beyond’s website, which features logos from both companies.

“It really felt like a no-brainer to us,” Overstock Chief Executive Jonathan Johnson told The Wall Street Journal.

The retailer still had valuable intellectual-property assets, some of which Overstock bought for $21.5 million in cash. Overstock acquired Bed Bath & Beyond’s trademarks, customer database and other brand assets.

These days there aren’t too many headlines from the WSJ that make me do a double-take and wonder if I read them correctly, but this is one of them. Here we have a well-established online brand and retailer in Overstock deciding to both buy the brand of a rival retailer after a very public liquidation AND simultaneously sunset its own brand by redirecting all their customers to the newly acquired brand’s website. It’s a perplexing decision to me on multiple levels and a case study in evaluating corporate strategy.

What are Overstock’s Strategic Goals?

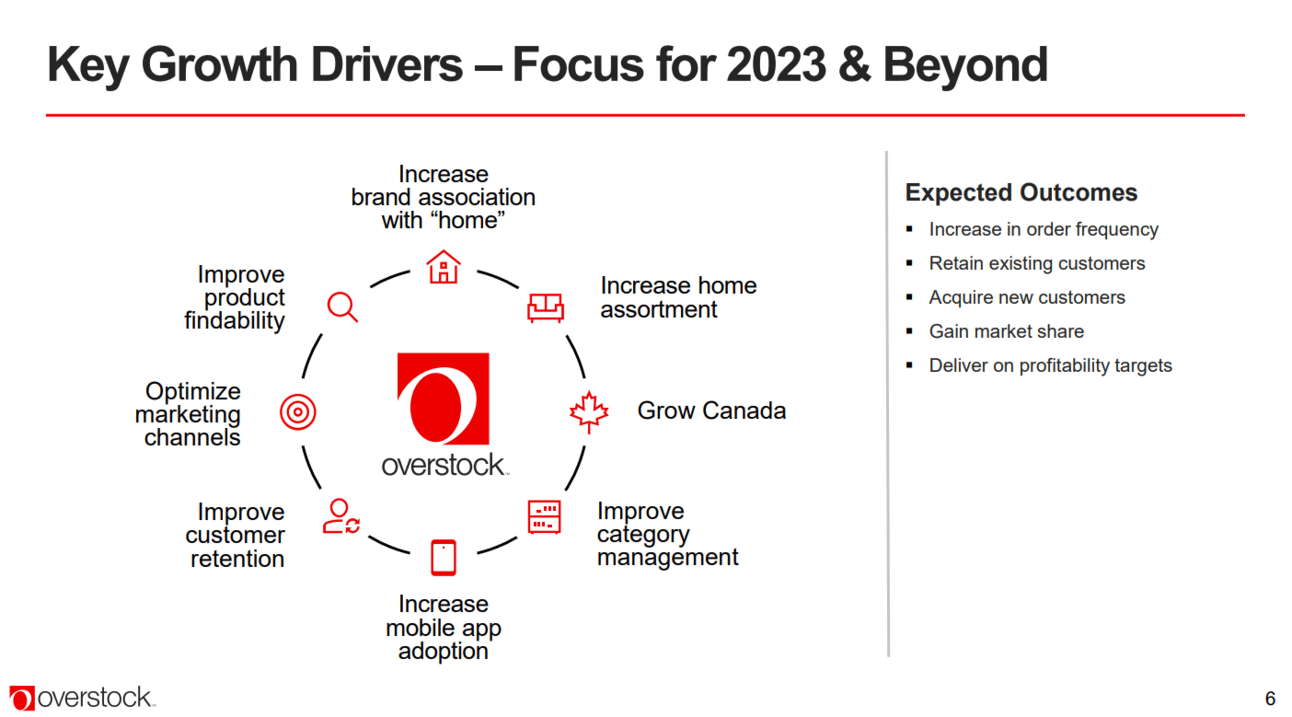

Overstock has many of the same strategic goals that you’d expect from any online retailer– goals like increase order frequency, attract and retain customers, grow profitability, etc. The company outlined these goals, and the growth levers they intend to pull to acheive them in their quarterly investor decks:

Everything on the page seems like logical and worthwhile goals to strive for. What is less logical is how the BBBY brand fits into this picture.

Why Acquire the BBBY Brand

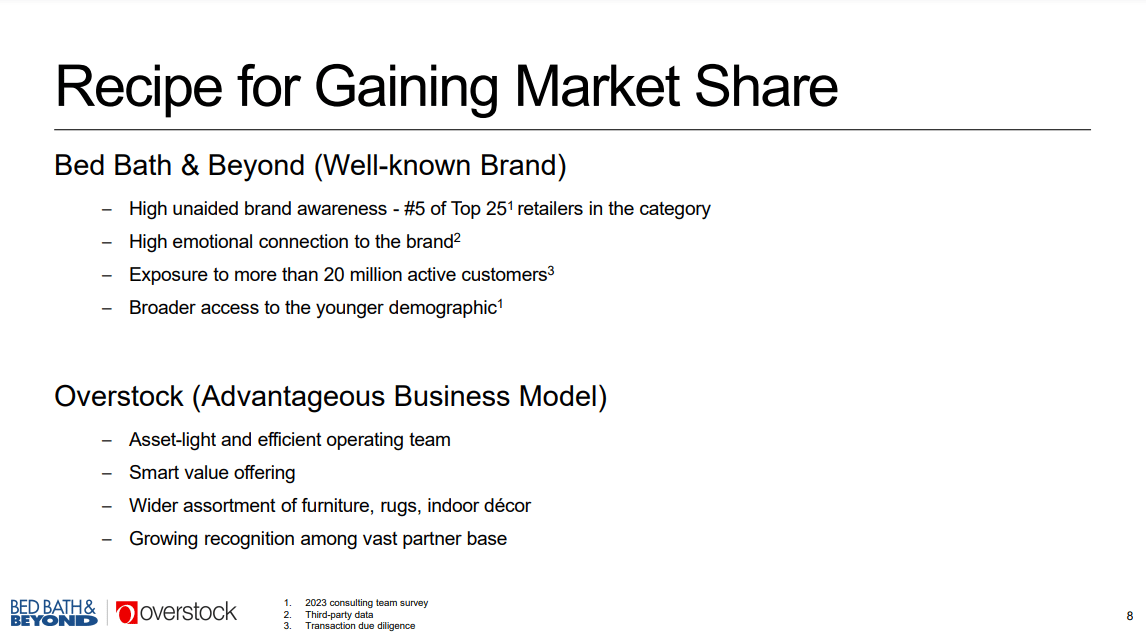

Thankfully we don’t have to do much digging to understand Overstock’s strategic rationale behind acquiring the BBBY brand. They spell it out for us in a deck from earlier this year. Here’s the explanation for the purchase in their own words:

Here’s where the strategic thought process starts to breakdown. “Recipe for gaining market share” is the clear takeaway they want investors to have from the acquisition. I can’t argue with wanting to gain market share (no one is trying to lose market share), but it’s unclear how well the BBBY brand supports that goal. There are a few claims about the strength of the BBBY brand on the slide, but an unanswered question is how much of that brand affinity was derived from customers’ relationship with BBBY brick and mortar stores, which notably were not acquired by Overstock and are now closed. Considering that BBBY’s ecommerce and app initiatives were still in a fledgling state, I would venture that most of their customers’ relationships to the brand were rooted in experiences at the physical stores and those ubiquitous blue coupons, a relationship that must have deteriorated to some degree when all those physical stores closed earlier this year. But with a price tag of just $20M, and access to BBBY’s customer data thrown in, I can understand Overstock’s leadership wanting to make a small bet on the brand. What I can’t understand is why they would throw away the Overstock brand in the process.

Why Discard the Overstock Brand?

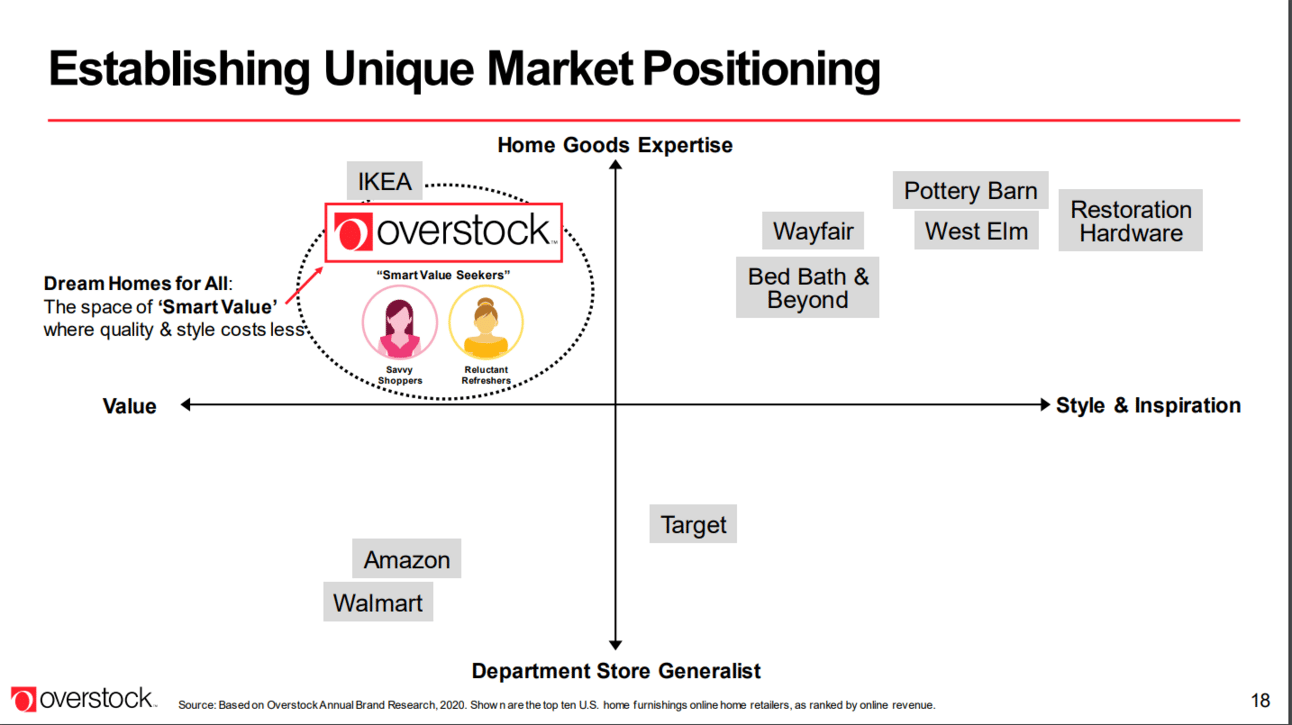

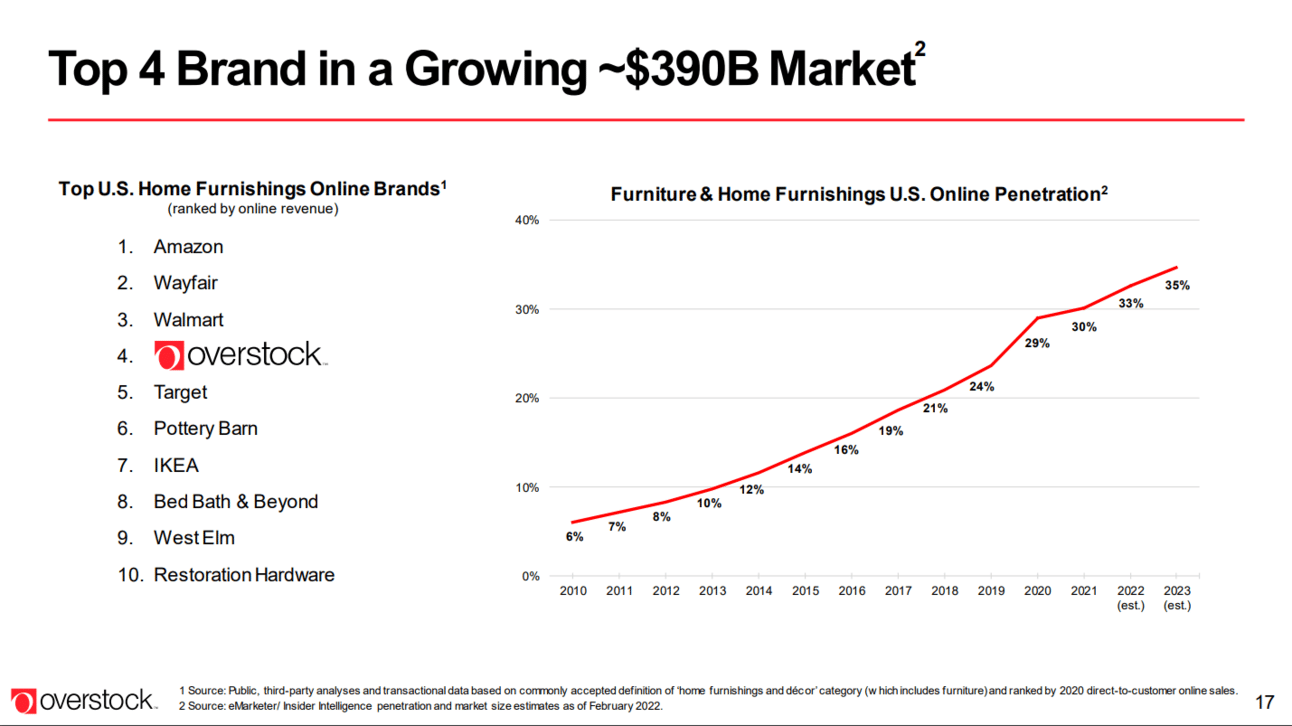

If the strategy was on shaky ground in the previous section, the decision to sunset the Overstock brand and replace it with BBBY is where it becomes downright perplexing. Here are two relevant slides from Overstock from 2022 that shows their view of the online home furnishings market:

If two of your stated goals are to retain existing customers and increase association with Home, it makes little sense to me why you’d trade down and redirect Overstock.com customers to BBBY.com when your own data tells you Overstock.com is the bigger brand in online home furnishings. Especially when Overstock and BBBY are operating at different ends of the value spectrum, it would make much more sense to operate both of these brands, appealing and capturing two different customer segments in the process. This is customer segmentation 101 and we see companies across nearly all industries execute this strategy successfully, from cars (Toyota and Lexus), to consumer goods (Budweiser and Busch) and even to mobile phone carriers. (Verizon and Visible Wireless).

Overstock leadership may believe that if they can reestablish the BBBY brand, they would then have an opportunity to offer more premium products and compete more directly with retailers like West Elm and Pottery Barn. I’m dubious of the slide’s claim that those brands were ever on equal footing from a value perception to begin with.

Where does Overstock go from here?

At the time of writing it’s been exactly 3 days since the US launch of the new Bed Bath & Beyond online store, so it’s fair to say Overstock deserves some time to let the initiative play out. Overstock paid a relatively small price for the optionality – a little more than $20 million dollars for the BBBY brand and its customer data. If you’re a poker player, the analogy would be calling a small bet to see the next card on the turn or river. The bigger mistake was how quickly they disposed of the Overstock brand. To return to the poker analogy, this is like choosing to push all your chips in when you could see the next card for free. A more logical, tempered move would be to test the BBBY.com and Overstock.com together to capture new customer segments, measure how the BBBY’s brand equity has held up after the closure of their physical stores, then let the market decide which of the two (or both) brands to support.