- Inflection Point

- Posts

- Real-time Data and the Job Market for MBAs

Real-time Data and the Job Market for MBAs

Looking beyond the narrative, what does the data tell us about the state of the job market for graduating MBAs?

Hi everyone,

In many of my career advising appointments with MBA students over the few months a common refrain I hear is about the poor state of the job market. Hearing that narrative always creates a bit of cognitive dissonance for me. The unemployment rate is historically low and the labor force participation rate is similarly high. Folding in ancedotal data, people in my network (both recent grads and mid-career professionals) are reporting more interviews and offers than compared to just a few months ago. But opinions and anecdotal data carry only limited weight. I wanted to see what data I could find to validate or invalidate different narratives about the job market, in particular for MBA grads looking to enter tech.

What do we know about today’s recruiting environment?

An abundance of talent – LinkedIn maintains a metric called “Labor Tightness” (Job Openings divided by Active Applicants) to evaluate the balance in the labor market. LinkedIn’s Labor Tightness ratio for the US has moved from 0.9 in Dec 2022 (i.e., 9 job openings for every 10 applicants) down to 0.5 (5 job openings for every 10 applicants) in June 2023. Linkedin does not split out data to show whether that metric is moving because of fewer job openings or more applicants (or both), but the next two data points indicate signs of strengths when it comes to job postings.

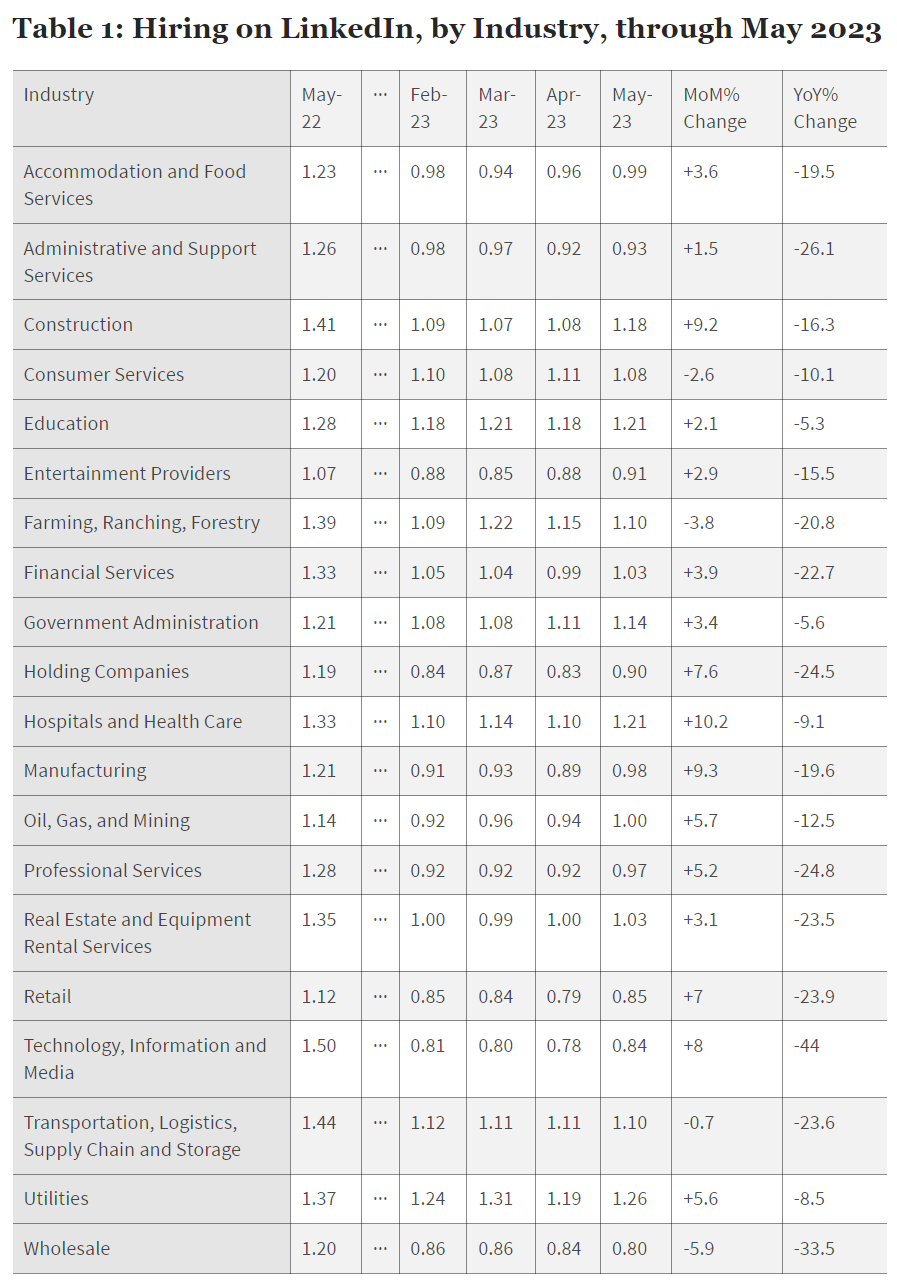

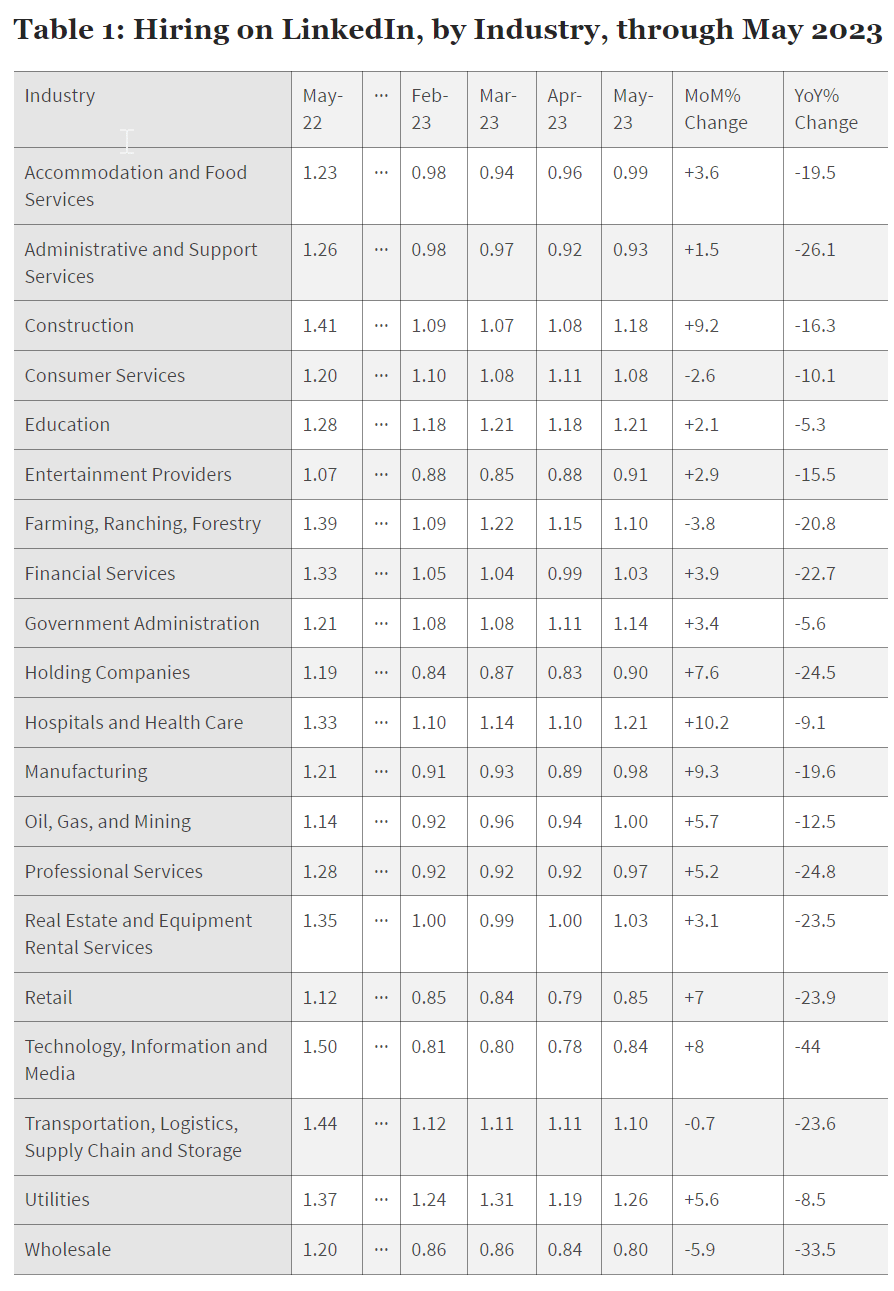

Hiring is improving compared to earlier this year, no contest vs. prior year. Linkedin has published another dataset that supports the narrative of an improving job marketing, including specifically within the Tech sector. In May 2023, Linkedin’s hiring rate metric (New Hires divided by LinkedIn Memberships) improved for the Tech (+8.0%), Professional Services (+5.2%) and Financial Services (+3.9%) sectors compared to the prior month. While each of these 3 sectors remain well below their prior year comps, the month over month improvement could serve as early indicators of rebounding strength in hiring for these sectors.

Google - one to watch: In a coverage report published in June 2023, analysts from Bernstein (paywalled via AlphaSense) made note of a dramatic increase of open roles at Google between March 2023 and June 2023, rising from approximately 500 to 2000 in 3 months. While the report provides no details on the types of new roles being opened, I find that a 4x increase in open roles at one of the leaders in Tech as a strong argument against the narrative of “no available jobs”.

What does this data mean for you as a job seeker?

Staying on top of job postings is critical – With competition for open roles at a multiyear high (albiet for an improving number of roles), it becomes critically important to identify and apply for open roles as early as possible. In tactical terms, that means visiting career sites, actively networking when you find interesting roles, and applying promptly.

Recruiters are seeking relevant experience, not just skills – Compared to last year’s recruiting environment, hiring managers can be extra selective with who they decide to interview and present offers to. That selectivity will often be driven by relevant experience and having relevant skills is likely not enough of a differentiator for applicants. Hiring managers and recruiters are now seeking relevant experience (e.g., company size, industry, functional role, product scope). As a job seeker, that means scrutinizing JDs and doing an objective self assessment on your fit for the role. I will still always encourage you to apply for roles you find interesting, but to prioritize the roles you apply for based on your fit for the role.

I hope this update provides a useful perspective on the state of the hiring market and tangible steps for you moving forward.